By: Gary M. Johnson, Computational Science Solutions

As the results of the 44th round of the Big Iron game of thrones are about to be announced, let’s put this in context by taking a synoptic look at the historical data from the perspective of competition among nations.

As the results of the 44th round of the Big Iron game of thrones are about to be announced, let’s put this in context by taking a synoptic look at the historical data from the perspective of competition among nations.

Over the years since 1993, a total of 58 countries have won a spot on the TOP500 list. We took a look at them several months ago in this article on the TOP500 Blog: Who Are the TOP500 List Countries?. Now let’s review a few measures of their performance over time.

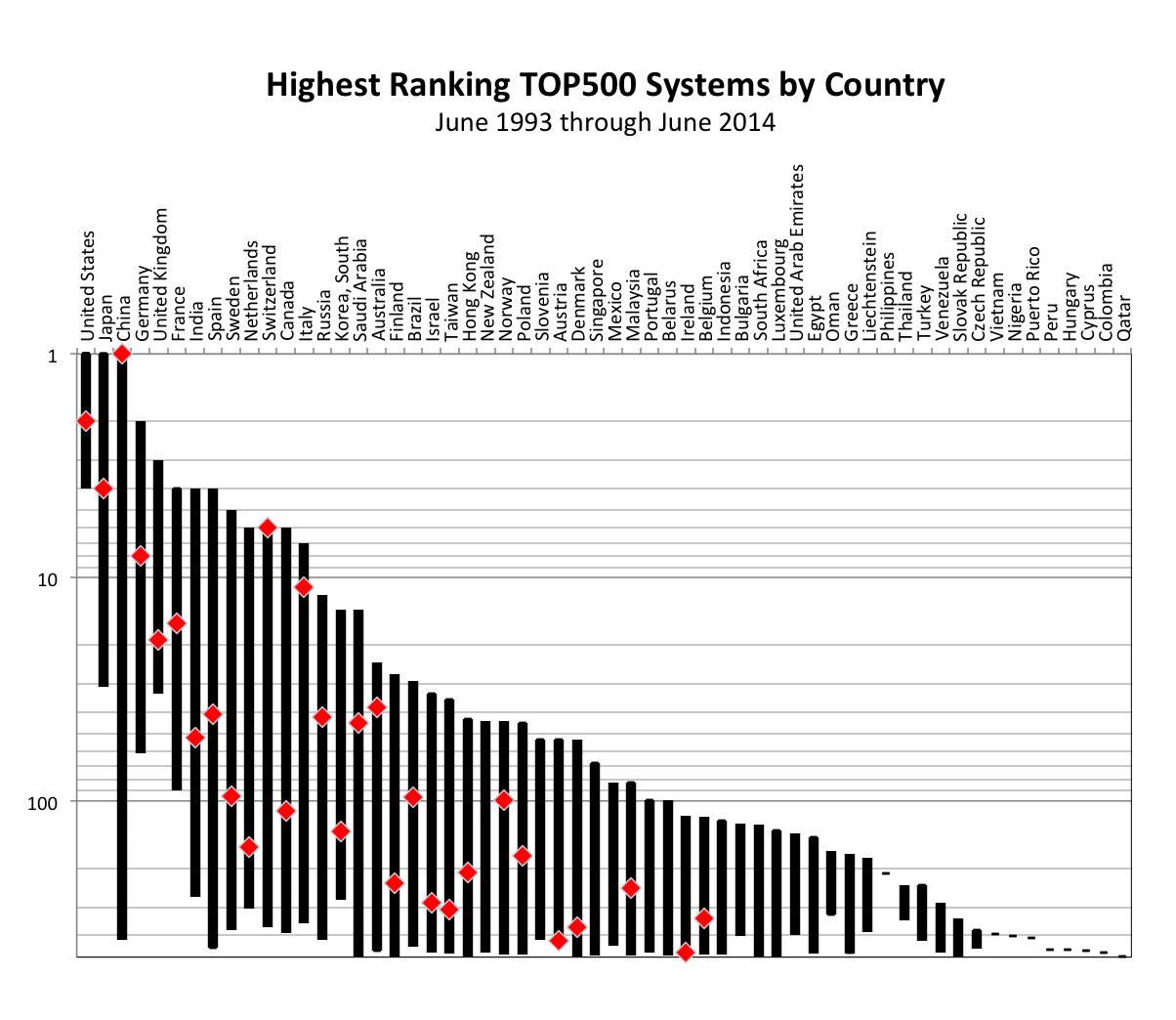

Highest Ranking TOP500 Systems

Below, we’ve plotted the range of highest rankings for each country, with their June 2014 rankings highlighted. As you can see, 25 of those 58 countries have never made it into the top 100 slots. Only 13 have reached the top 10 and the sole country consistently in the top 10 has been the United States.

But the picture is more complicated than this. Only 3 countries have so far reached the top spot on the list: United States, Japan and China – the current occupant being China. Note that China has rocketed to occupy the Big Iron Throne from a low position of 418 in November of 1999.

So, if having top systems is important to a country, only a limited sense of security can be derived from consistently being near the top. Motivated players can change the game.

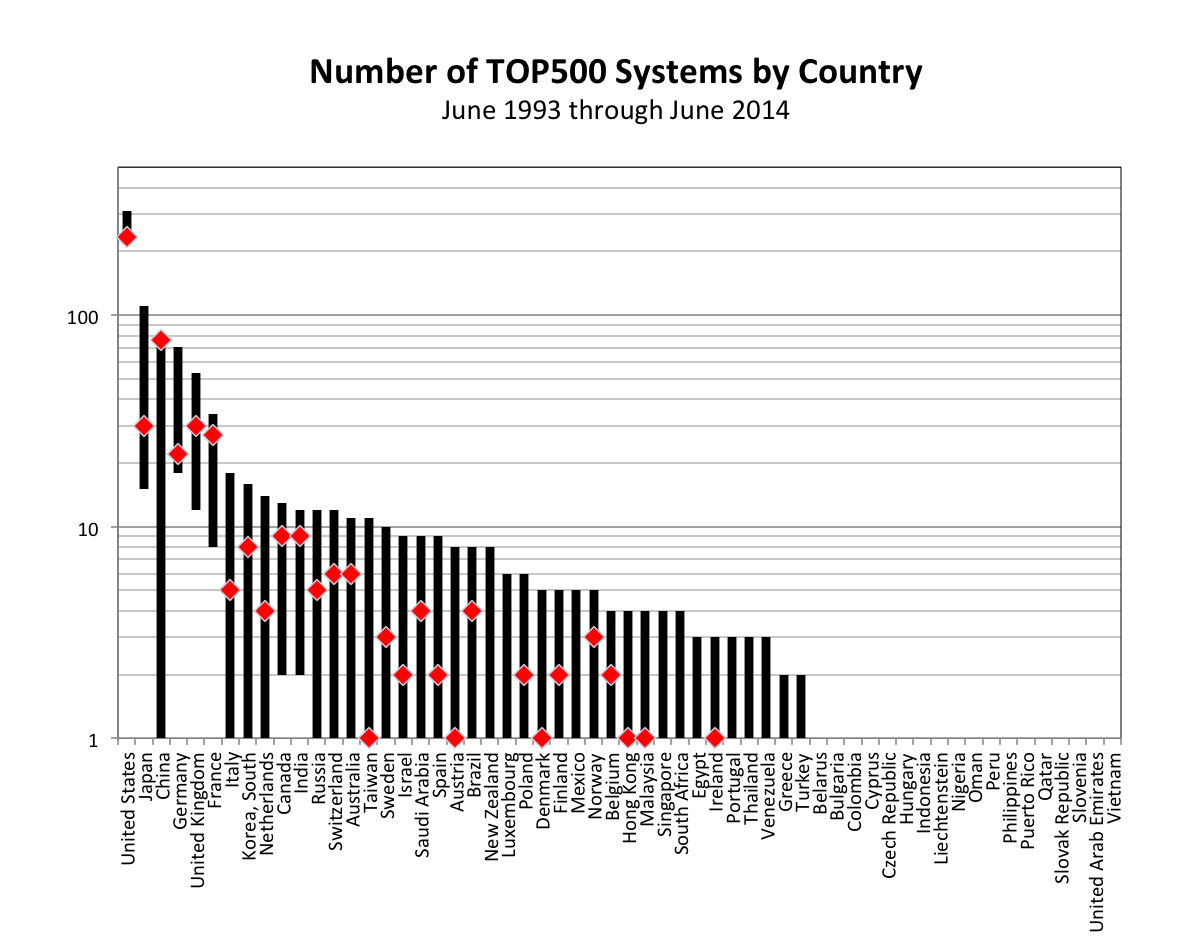

Number of TOP500 Systems

Having the top system is just part of the story. The most powerful computers are justified by their unique capabilities to push the envelope on important applications. In doing so, they can only usefully support a small number of users. So, to support broader national goals, having a lot of powerful systems would be beneficial.

Here, the United States is the clear winner, never having had fewer than 226 systems on the list (in June 2002). The only other country to have had more than 100 systems on the list is Japan. The countries other than the US and Japan to have consistently had more than 10 systems on the list are Germany and the United Kingdom. 42 countries have never made it to the 10-systems level.

However, notice that China is rapidly approaching the 100-systems mark, having moved from a low of 1 system in November 1999 to its current stable of 76 systems.

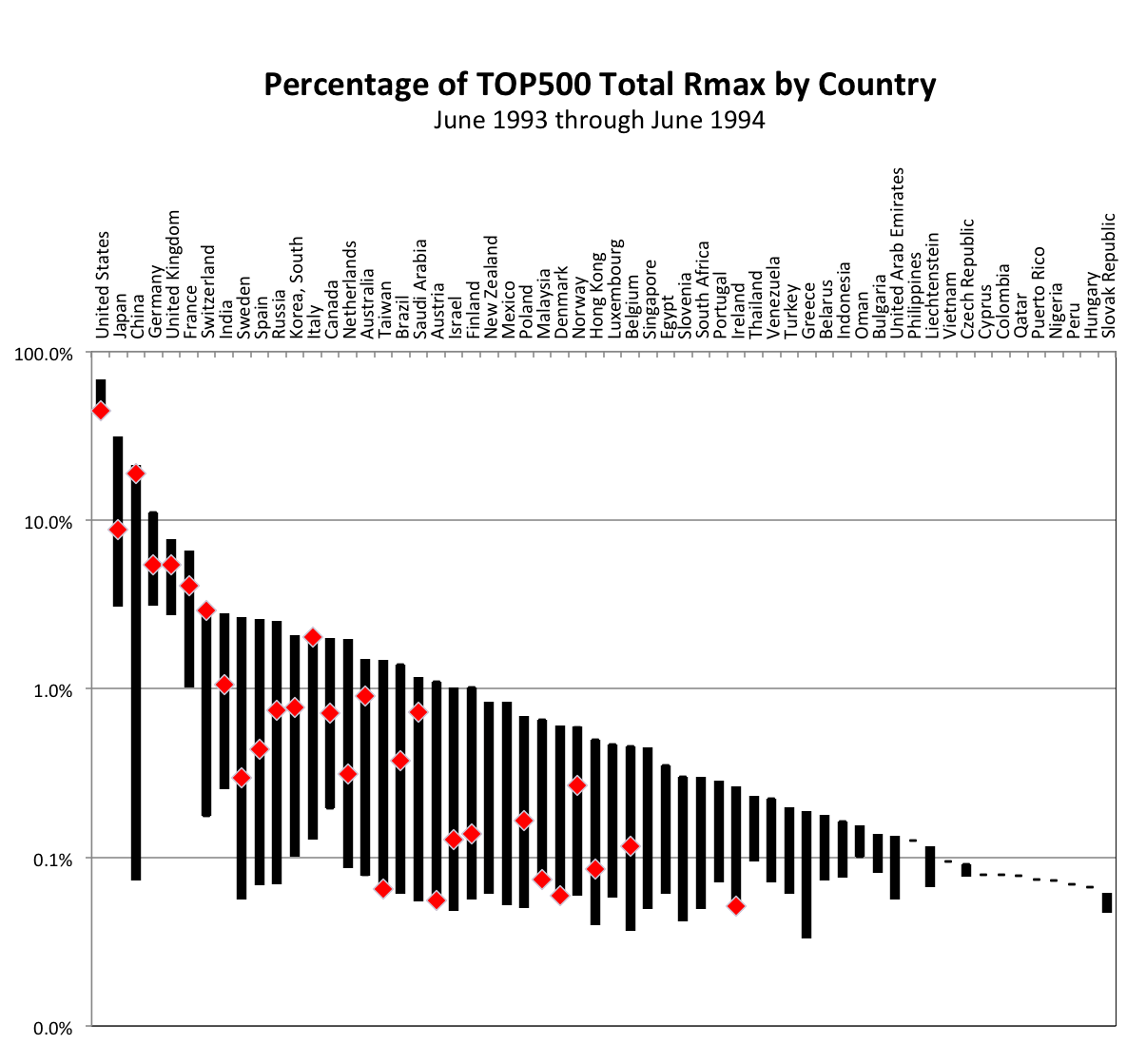

Percentage of TOP500 Total Rmax

Another dimension to the game of Big Iron thrones is how much aggregate capability a country has at its disposal. We’ll assess this by looking at the percentage the various players have of the sum of Rmax (maximum Linpack performance) over all 500 systems for any given list, as shown below.

Here again the United States is the clear winner as the only country to consistently have more than 10% of total Rmax. In fact, the smallest share of Rmax that the US has had is just under 43% (in 2011). The other countries to have exceeded the 10% level are Japan, China and Germany. China has moved rapidly from possessing 0.07% of Rmax in 1999 to its current level of 19%.

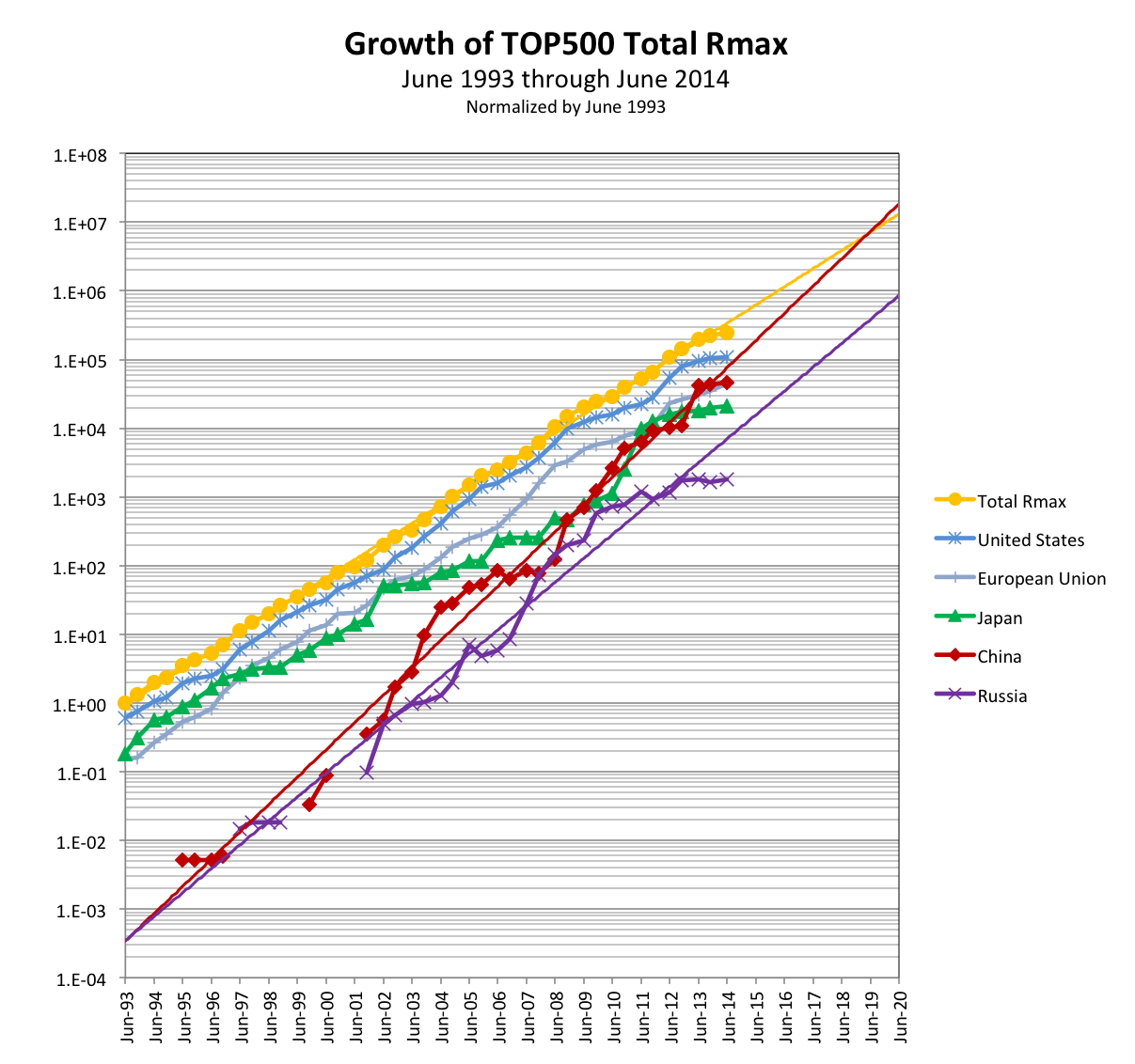

Rmax Growth Rates

Since not all countries appear to be proceeding at the same pace in the Big Iron game, it’s useful to take a look at growth rates. Below, we’ve plotted Rmax growth rates for the US, European Union, Japan, China and Russia and, for comparison, the growth of TOP500 total Rmax. As may be seen, the rates of growth for the US, EU and Japan track the TOP500 list trend pretty well. However, China’s growth rate is significantly higher. If this trend of China’s continues for a few more years, it will own essentially all of Rmax. Notice also that Russia’s growth rate is somewhat higher than the overall trend. Perhaps this indicates that it is a player to watch in the future.

Enthusiasm for the Game

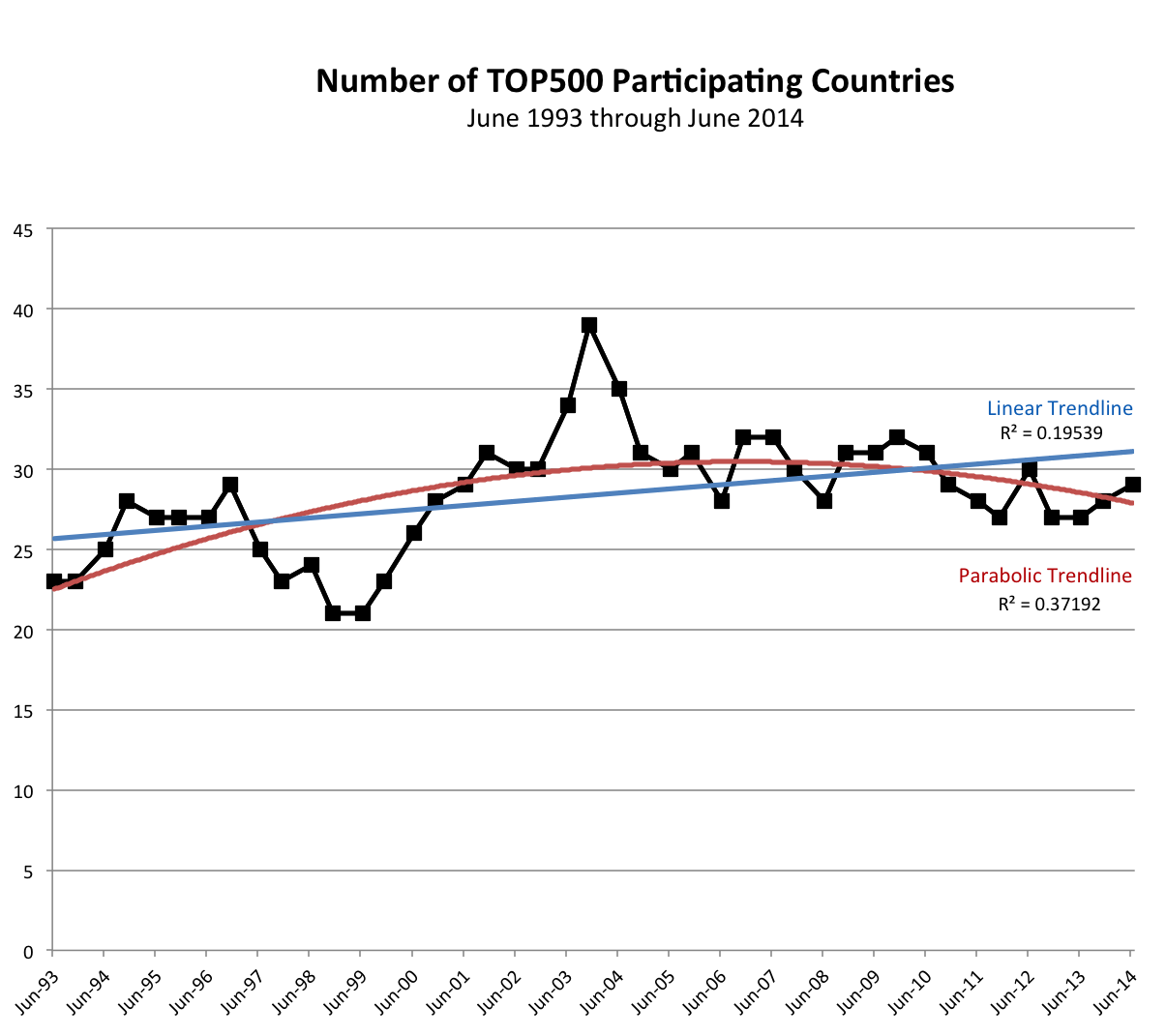

As mentioned previously, a total of 58 countries have played the Big Iron game at one time or another since 1993. The highest number of players, 39, occurred in November 2003 and the lowest, 21, in November 1998 and June 1999. Below we’ve plotted the number of players versus time. We’ll use the resulting trend as an indicator of overall player enthusiasm.

Two trendlines have been used to fit the data: linear and a parabolic curve. It’s unclear which to focus on – but the parabolic curve is a better statistical fit to the data (higher R2 value). So, is enthusiasm for participation diminishing? It’s hard to say – but it is clear that participation isn’t growing rapidly.

Perhaps what we’re seeing is some indication that the number of players will contract over time, as the bigger players field systems that consume ever larger portions of Rmax and squeeze out the smaller ones.

Resource Commitment

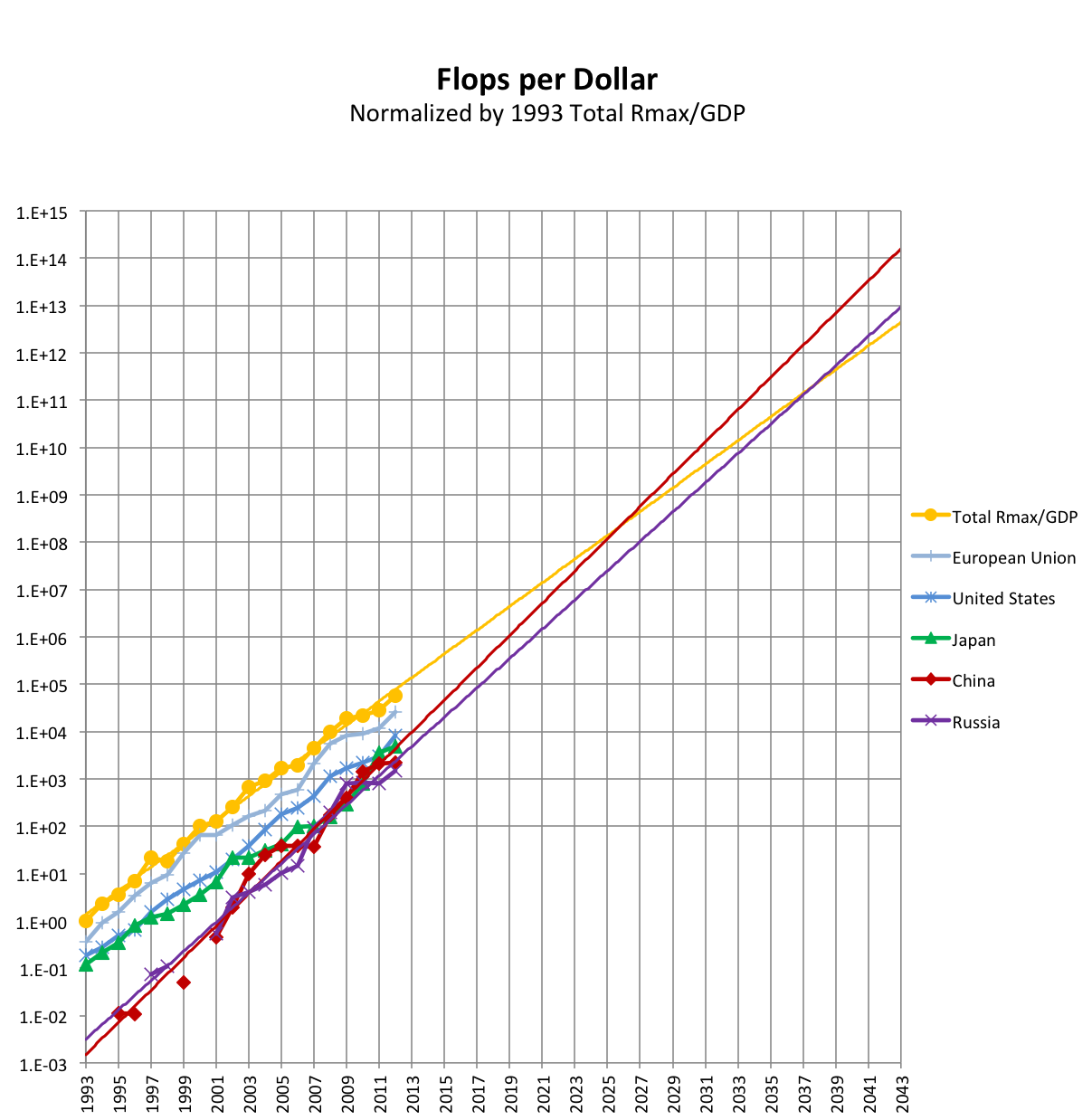

To investigate the level of resources that the players are willing to commit to the Big Iron game, we’ve chosen to look at Rmax normalized by Gross Domestic Product (GDP). Below, we’ve plotted the resultant Flops/Dollar for the US, European Union, Japan, China and Russia – and, for comparison, the corresponding value for the whole TOP500 List.

So, what we’re looking at is: Given a player’s GDP, how many Flops are they willing to invest in? Since over time, Flops become cheaper – and GDPs larger, we’re mainly interested in slopes rather than values. This is a very rough metric but still revealing.

We see that the trends for the US, EU and Japan are all similar to the overall trend. Though the EU does seem a bit more committed to spending GDP on Flops than does either the US or Japan.

China appears to be committing GDP to Flops at a significantly higher rate than the overall trend. Russia seems also somewhat more committed to the game than the current big players.

Closing Thoughts

For most of its history, the Big Iron game has been dominated by the United States, together with perhaps a few other countries. Things might now be changing.

The overall number of players may diminish, as ever larger systems at the top of the TOP500 List consume larger percentages of total Rmax and push the smaller players off the bottom.

The mix of top players may also change, if some countries, like China and perhaps Russia are willing to commit larger portions of their GDP to Flops than the other players are.

One thing is certain: the Big Iron game will continue to be interesting to both participants and fans.