July 19, 2016

By: Michael Feldman

Japanese IT conglomerate SoftBank announced it is buying ARM Holdings, the UK-based microprocessor designer, for £23.4 billion, or about $32 billion. The deal came as surprise to many tech industry followers since until now SoftBank has played mainly in the mobile telecom space, with forays into internet services.

The offer represents a 43 percent premium over ARM’s stock price at the time the acquisition was made public. Subsequent to the announcement, ARM’s stock spiked, rising by about 40 percent. Meanwhile, SoftBank’s stock tanked on the news, falling by more than 11 percent.

The offer represents a 43 percent premium over ARM’s stock price at the time the acquisition was made public. Subsequent to the announcement, ARM’s stock spiked, rising by about 40 percent. Meanwhile, SoftBank’s stock tanked on the news, falling by more than 11 percent.

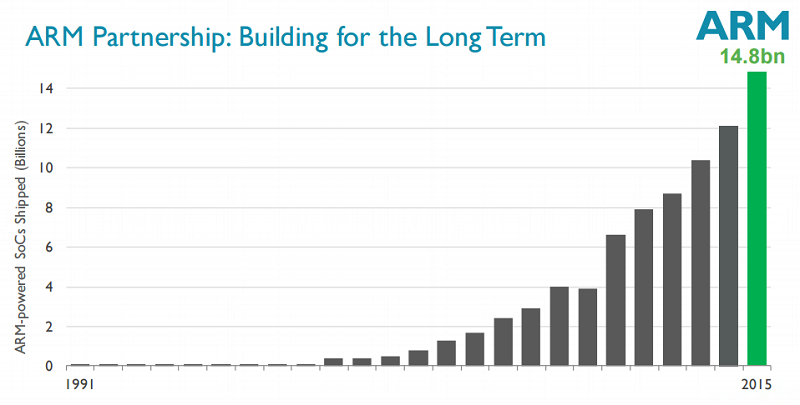

Masayoshi Son, the company’s chairman and CEO, characterized the acquisition as part of a long-term strategy to invest in the internet of things (IoT), an area he sees as fertile ground for the energy-efficient ARM technology. Sales of ARM chips have been growing rapidly over the last decade, thanks to the explosion of mobile devices used by consumers. ARM processors power 95 percent of all smartphones, and are the dominant chips in almost every other mobile device on the market. As the nascent IoT space of drones, autonomous cars, and smart appliances heats up, ARM is well-positioned to dominate here as well.

ARM Holdings does not sell any processors on its own. Rather it licenses the technology to other chipmakers and system integrators, such as Qualcomm, Apple, Samsung, and a multitude of others. Over the past few years, ARM technology has been extended to the server space, with companies like Applied Micro, Cavium, and AMD signing up for 64-bit ARM V8 licenses, and which now all offer their own implementations. Chip giant Qualcomm is also building an ARM processor for datacenter servers. Meanwhile, Fujitsu, in collaboration with ARM, has committed to creating a supercomputing version of the processor.

Source: SoftBank

Source: SoftBank

ARM Holdings has been adept at juggling all of those various design with only about 3,000 employees. SoftBank has committed to doubling that head count over the next five, as well as expanding the company’s overseas footprint. Masayoshi Son did not specify exactly how he would do this, but presumably it’s tied to his plans for expansion into the IoT market.

The deal has taken some heat from a number of financial analysts, many of whom believe the transaction will burden the company with too much debt – about $10 billion dollars more when the acquisition completes. A related worry is there will be less funds available to invest in Sprint, the US wireless carrier SoftBank has a controlling stake in. Given SoftBank’s tumbling stock price since the news was announced, many investors seem to agree the deal is risky.

In fact, some of the company’s shareholders are balking at the move. According to a report in The Guardian, a number of SoftBank’s biggest investors don’t understand Son’s rationale for the ARM buy and are worried that it will destroy shareholder value. And at least one analyst, Neil Campling, at Northern Trust Capital Markets, speculates that “Apple, Intel, Qualcomm, Microsoft and Google could emerge as rival bidders for ARM.” For the time being though, Son, who is the largest SoftBank shareholder, appears to be adamant about seeing the deal through, saying, “if the investors do not like it, they will sell.”