Oct. 19, 2016

By: Michael Feldman

Intersect360 Research has released its latest five-year forecast that projects spending on high performance computing from now through 2020. The report covers the gamut of HPC offerings, including servers, storage, networks, cloud computing, and other services.

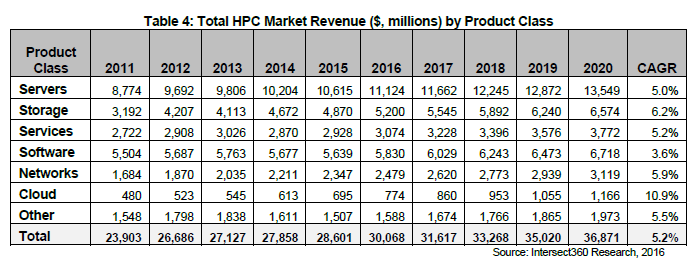

From 2016 through 2020, the analyst firm is projecting the aggregate HPC market will grow at a compounded annual growth rate (CAGR) of 5.2 percent. That’s up a full point from the last year’s forecast that covered 2015 through 2019. The current projected growth rate will put the total market value at $36.9 billion by the end of 2020.

The forecast uses 2015 as a starting point, which saw $28.6 billion spent on HPC products and services, according to the Intersect360 data, a 2.7 percent bump from 2014. Servers continue to be the largest segment, claiming $10.6 billion of that total.

Likewise for the five-year forecast, where servers represent the biggest piece of the product pie over the entire forecast period. “Servers will lead the market in terms of absolute revenue growth, adding about $2.9 billion to the market by 2020, or 37% of the total additional revenue.” Here’s the full 10-year breakdown by product class using the previous five years of collected data and projected out through the forecast period:

HPC spending by industry and commercial businesses continue to drive the market with a five-year growth rate of 6.8 percent. Growth in both government and academia are projected to be less than half of that, with CAGRs of 3.0 percent and 3.2 percent, respectively. The slower expansion of public spending in HPC is attributed to continued government austerity, which the report says looks like it could become a long-term trend.

It’s noteworthy that the forecast does not include market data for most of the spending associated with artificial intelligence/machine learning, which by all accounts is still relatively small, but growing significantly faster than the more traditional HPC sub-segments tracked in this report. At this point, the vast majority of the money spent specifically for AI/machine learning infrastructure is being shelled out by the big hyperscale players – Google, Microsoft, Baidu, Amazon, Facebook and a few others (although undoubtedly some AI codes are being run at HPC facilities).

Intersect360 will capture the dynamics of this application space under its own hyperscale super-segment, which they recently split off from their high performance business computing super-segment. We look forward to any upcoming studies.