Aug. 29, 2016

By: Michael Feldman

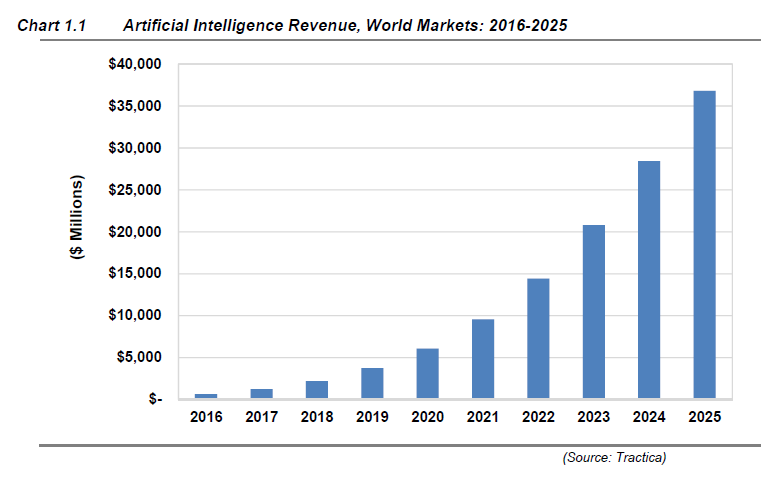

A new report from market research firm Tractica forecasts that the annual global revenue for artificial intelligence products and services will grow from 643.7 million in 2016 to $36.8 billion by 2025, a 57-fold increase over that time period. As such, it represents the fastest growing segment of any size in the IT sector.

According to the report, “AI has applications and use cases in almost every industry vertical and is considered the next big technological shift, similar to past shifts like the industrial revolution, the computer age, and the smartphone revolution.” Even ignoring that bit of hyperbole, a good case can be made that artificial intelligence certainly has the potential to upend a lot of industries, government activities and consumer behavior. In its report, Tactica identifies 27 verticals that are employing AI technologies today or soon will be. These include financial services, healthcare, defense, consumer retail, advertising, and media & entertainment, among others.

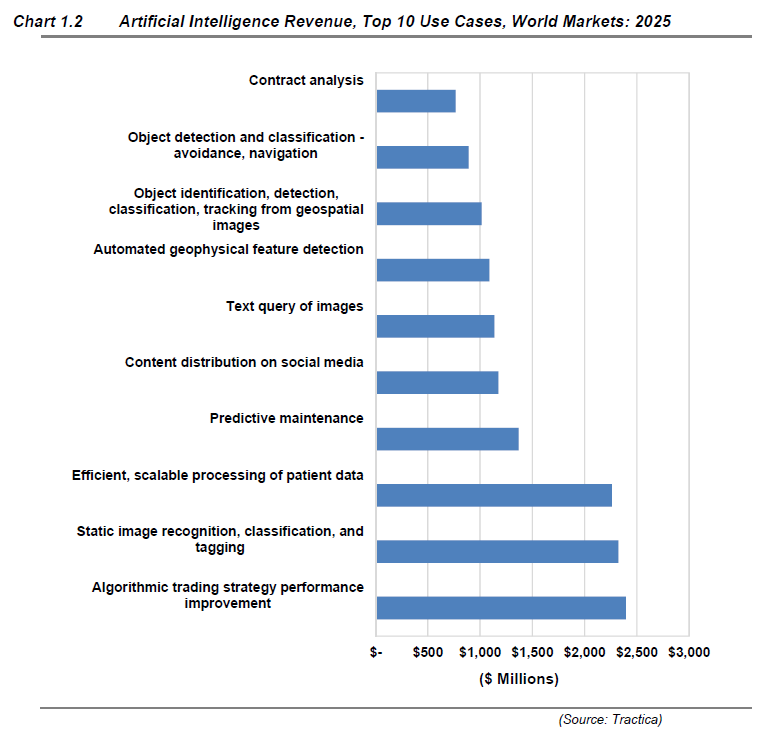

In terms of revenue, the top use case of the 191 they identified is algorithmic trading. Here the investment banks and hedge fund firms are already using AI algorithms to drive their portfolio strategies. The researchers estimate -- conservatively they say -- that by 2025 roughly half of investment assets will be traded via AI. The top 10 use cases are charted out below.

Tractica slices AI categories a few ways. One way is differentiating between things like image/object recognition and big data-related approaches, which they propose as a high-level way to split different AI models. An example of recognition technology is using geophysical feature detection to derive intelligence from images collecting by oil and gas companies, whereas a big data-related model would be what the hedge fund guys are doing on their investment portfolios.

Of the top 10 use cases, the Tractica report attributes 60 percent of them to big data, with the remaining 40 percent to image/object recognition, and this how they see the overall shape of market. And even though these 10 use cases dominate AI revenue today, the report say they will account for about 40 percent of the overall software market by 2025.

Another way Tractica categorizes AI is by technology. The report cites deep learning, computer vision, and natural language processing (NLP) as the big technology areas. Somewhat confusingly, the researchers also split out machine learning as a separate non-deep-learning technology. In any case, deep learning represents the largest revenue slice today, which the Tractica analysts calculate is worth about $308.4 million in 2016, and will grow to $16 billion by 2025.

This being TOP500 news, it’s worth asking the question how this market and set of technologies intersects with the HPC space. There’s a general consensus that the AI and HPC markets overlap, and remainder of AI that does not overlap is viewed as an adjacent market. Certainly deep learning, an application set that employs terascale GPU or FPGA clusters to run compute-intensive matrix operations in a highly parallel fashion, would be considered HPC by almost anyone’s standard. Likewise, IBM’s Watson cognitive computing offering, along with the Big Blue’s various “smarter planet” initiatives, represent applications with a level of data-intensity and algorithmic complexity that would qualify them as high performance computing to most observers. In other cases, as in weather prediction, deep learning techniques are being used to replace or augment conventional HPC physics-based simulations.

The reason this matters is that the growth rate of AI will shape the strategies and product sets of HPC vendors and their customers. For companies like NVIDIA, this is already occurring, with the designs of their Tesla GPUs being significantly influenced by the needs of deep learning applications. Intel is now pursuing a similar strategy with its Xeon Phi line. As we’ve noted previously, NVIDIA’s attributed nearly half of its datacenter revenue of $151 million for its most recent quarter to sales of GPUs for deep learning applications. Even if that turns out to be a banner quarter for such sales, NVIDIA is almost certainly on track to realize over $100 million from deep learning this year, and perhaps two, or even three times that amount.

If true, even the conservative estimate would give NVIDIA about a third of deep learning revenue for 2016 using Tractica’s $308.4 million figure. Of course, this presumes the Tractica number is accurate and includes such hardware revenue. But assuming it is and it does, and the report’s 10-year projection plays out, by the time 2025 rolls around, NVIDIA could be generating $5 billion a year from deep learning -- a number that is equal to its total revenue in 2015 – and perhaps much more.

The larger point is that many HPC vendors are in a good position to tap into this market. Given the confluence in technologies, industry verticals, and application areas, many AI users are now or will soon become good prospects for HPC products, and vice versa. And given the much higher growth rates of AI – over 100 percent CAGR if you believe Tractica’s forecast – even a partial market overlap is going to change the dynamics of the HPC space.

It’s important not to lose sight of the fact that the market for high performance computing is much larger than that of artificial intelligence, and even by 2025 is likely to be larger (although no market research firms have offered a 2025 revenue prediction for the HPC space.) According to Intersect360 Research, in 2015 total HPC revenue reached $28.6 billion, while IDC pegs that year’s number at $23.1 billion. The few hundred million that could be attributed to HPC-flavored AI in 2015 wouldn’t sway those figures significantly, although it’s not inconsequential.

But by 2020, Tractica predicts the AI market will reach around $6 billion, which is still a long way from the $36.9 billion forecast by Intersect360 for HPC that year or the $31.4 billion IDC is predicting for HPC revenue in 2019. However, it does suggests AI will represent a much larger slice of the HPC pie by the turn of the decade, and considering the disparate growth rates of traditional HPC and artificial intelligence, the AI piece is apt to get larger as time goes by. This is all good news for vendors and users, who will benefit from the innovation, not to mention money, infusing the AI market. Just when you thought HPC might get boring…